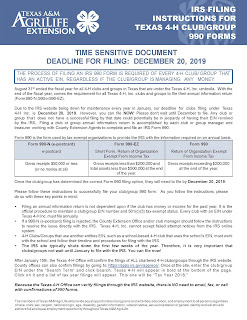

THE PROCESS OF FILING AN IRS 990 FORM IS REQUIRED OF

EVERY 4-H CLUB/GROUP THAT HAS AN ACTIVE EIN, REGARDLESS IF THE CLUB/GROUP IS

MANAGING ANY MONEY.

August 31st ended the fiscal year for all 4-H clubs and

groups in Texas that are under the Texas 4-H, Inc. umbrella. With the end of

the fiscal year, comes the requirement for ALL Texas 4-H, Inc. clubs and

groups to file their annual information return (Form 990-N, 990 or 990-EZ).

Due to the IRS website being down for maintenance every year

in January, our deadline for clubs filing under Texas 4-H Inc. is December

20, 2019. However, you can file NOW! You do not have to

wait. Any club or group that does not have a successful filing by that date

could potentially be in jeopardy of having their EIN revoked by the IRS. Filing

a club or group annual information return is accomplished by each club or group

manager and treasurer working with County Extension Agents to complete and file

an IRS Form 990.

Link to 990-N User Guide: User Guide